Investing & Performance | 8 April 2025

navigating the current investment environment

Fahad Kamal, Chief Investment Officer at Coutts, shared his views on current market volatility at a virtual event for clients yesterday. Here are the key points.

Fahad Kamal, Chief Investment Officer

Positive signals remain for long-term investors despite the exogenous shock markets experienced from last week’s US tariff announcement.

Those signals include a reasonably solid US economy, markets showing a strong record of recovery from periods of elevated volatility, and opportunities from lower company share prices.

Fahad Kamal, Chief Investment Officer at Coutts, shared his latest views at an investment event for Coutts’ clients this week. He told the audience: “The tariffs came at a level that surprised markets and investors around the world. The resulting volatility will continue for the time being, and there is still a lot of uncertainty around what will happen next.

“But the underlying economy and historical evidence give us every reason to believe the situation will improve over time.”

Past performance should not be taken as a guide to future performance. The value of investments, and the income from them, can fall as well as rise and you may not get back what you put in. You should continue to hold cash for your short-term needs. This article should not be taken as advice.

Fahad Kamal, Chief Investment Officer

Positive signals remain for long-term investors despite the exogenous shock markets experienced from last week’s US tariff announcement.

Those signals include a reasonably solid US economy, markets showing a strong record of recovery from periods of elevated volatility, and opportunities from lower company share prices.

Fahad Kamal, Chief Investment Officer at Coutts, shared his latest views at an investment event for Coutts’ clients this week. He told the audience: “The tariffs came at a level that surprised markets and investors around the world. The resulting volatility will continue for the time being, and there is still a lot of uncertainty around what will happen next.

“But the underlying economy and historical evidence give us every reason to believe the situation will improve over time.”

Past performance should not be taken as a guide to future performance. The value of investments, and the income from them, can fall as well as rise and you may not get back what you put in. You should continue to hold cash for your short-term needs. This article should not be taken as advice.

three key factors

Fahad reminded those who joined the event that Coutts, as a long-term investor, “doesn’t engage in knee-jerk reactions”. Reasons he gave for maintaining current confidence despite the tariff turbulence include:

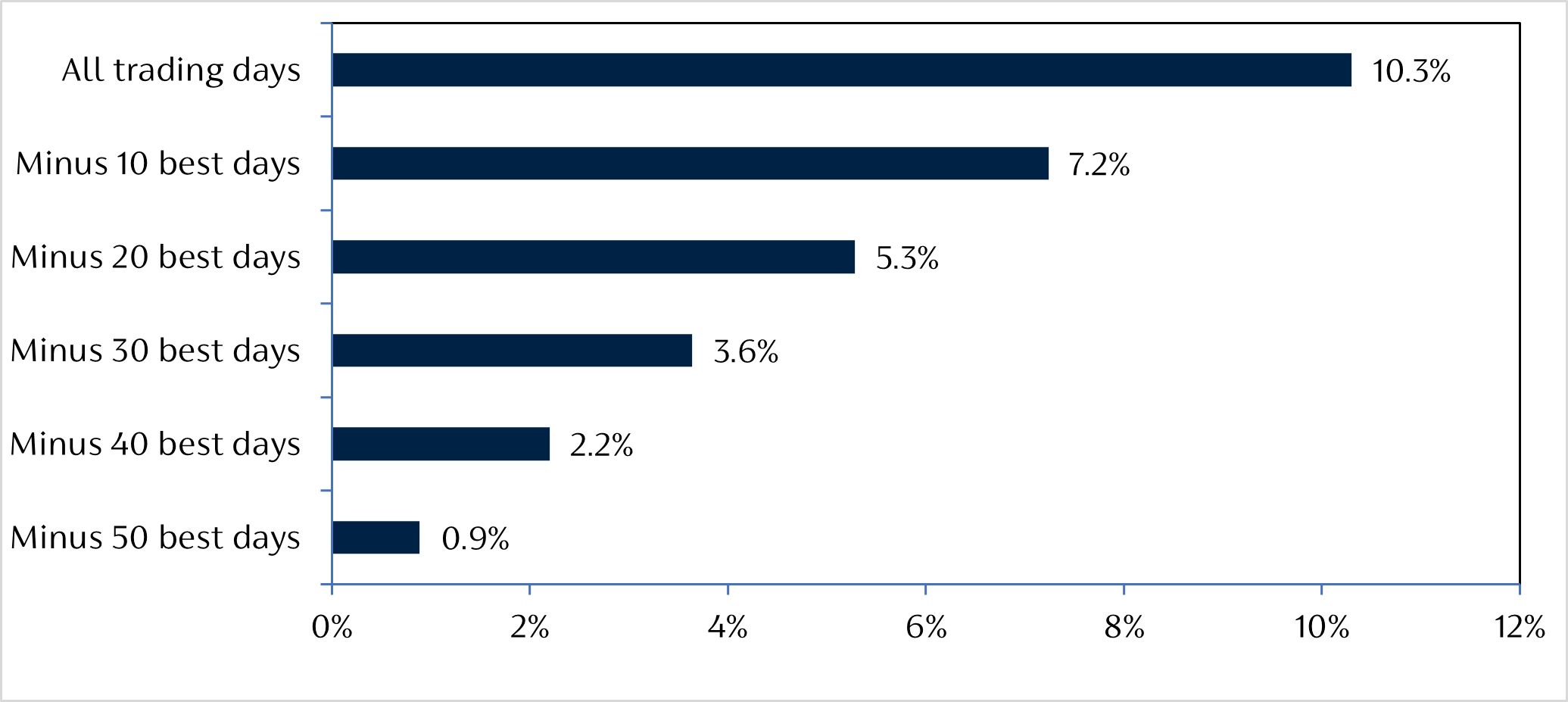

Missing the best trading days in the market could have a long-term impact

Global Equities - Annual returns from 31 December 2008 to 31 December 2024

Source: Refinitiv, Coutts. Annualised total return of MSCI World Index from 31/12/2008 – 31/12/2024

evidence based decisions

Fahad said his team were “actively monitoring the situation and Coutts’ investment positioning”, employing a wealth of real-time data and analysis.

“Any actions we take in portfolios are probability-weighted and evidence based,” he said. “We do not make headline-driven decisions.”

He said a strong element of Coutts’ investment approach within its multi-asset strategies was diversification – designed to help cushion investments from the worst of the falls at times like this.

The audience heard how Coutts diversifies its holdings in a number of ways.

“We hold US Treasuries, which have been a really reliable hedge over the last few days,” Fahad said. “We also bought more exposure to sterling-hedged assets this year. This has helped because sterling has been strengthening against the US dollar.”

Fahad also mentioned Coutts’ proprietary liquid alternatives fund, another important diversifier which focuses on areas with low sensitivity to traditional stock and bond markets. It aims to generate stable returns regardless of whether those markets rise or fall.

“Time and time again markets have shown remarkable resilience over the long term.”

Lillian Chovin, Head of Asset Allocation

moving forward

While Fahad acknowledged the difficulty of such challenging times for investors, he stressed that “time and time again markets have shown remarkable resilience over the long term”.

“We are in an intense period of volatility caused by a lack of clarity,” he said. “It has happened before, it will happen again. History tells us greater clarity will emerge. And when it does, companies and investors should be able to get on with the business of moving forward.”

Speak to us

If you are a Coutts client and would like to discuss market developments or your own investments with us in more detail, please contact your private banker.

More insights