Investing & Performance | 11 March 2025

Investment update: US policy uncertainty increases but fundamentals and company earnings remain strong

Recent US policy changes have raised concerns over the stability of the economy but we still see strong company earnings and solid long-term fundamentals for investors.

Stock markets dropped on Monday as investors grew increasingly unsure about the impact of numerous US policy shifts on tariffs. While this current uncertainty could cause economic growth to slow in the US, the outlook for company earnings remains solid and we don’t see a recession on the horizon.

Meanwhile, geopolitical news in Europe has been contributing to investor uncertainty. The European Union has announced plans to become less reliant on the US, with several nations committing to raise fiscal spending to fund their defence budgets.

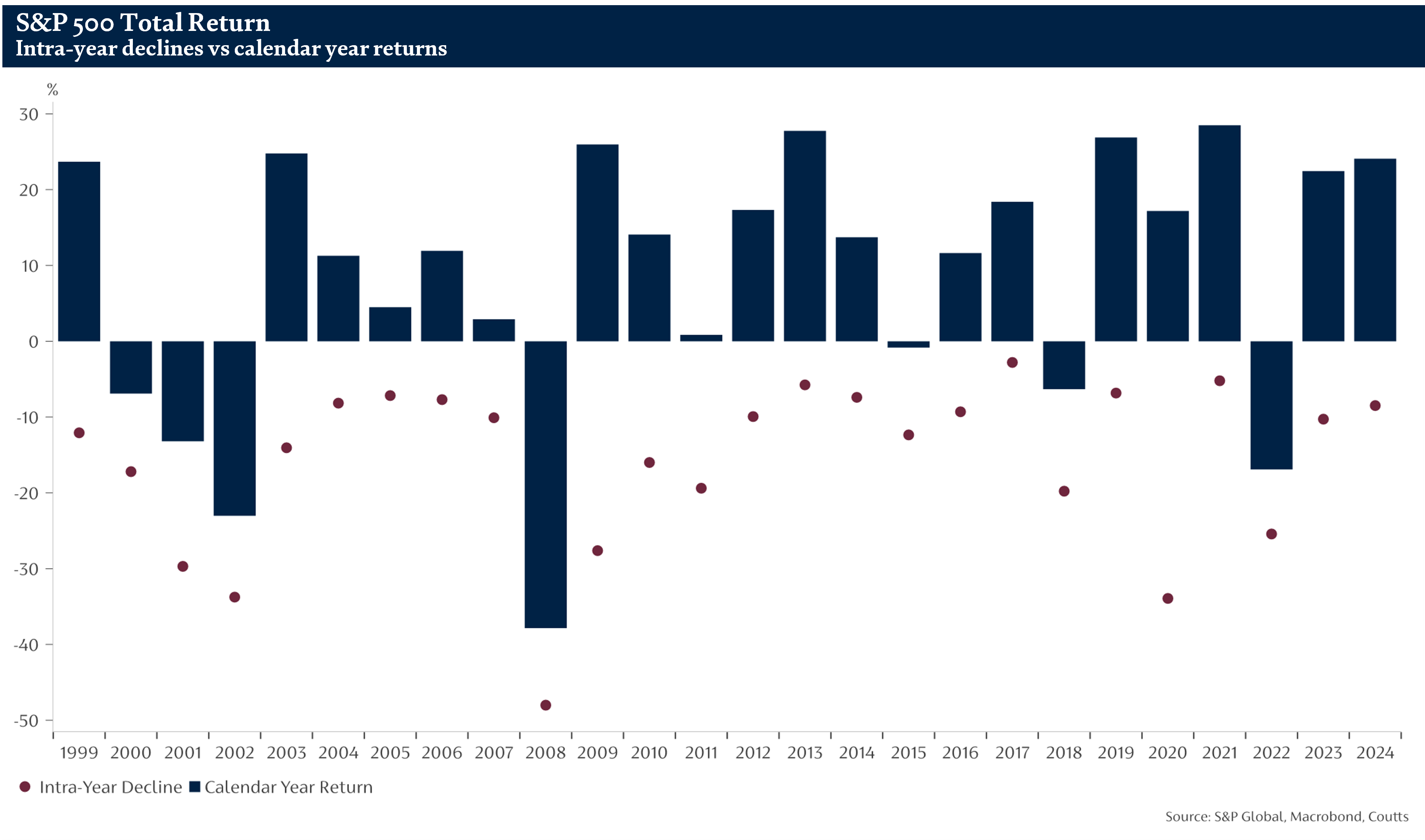

Coutts’ Chief Investment Officer Fahad Kamal said that, while such political uncertainty can impact markets over the short term, history shows they tend to recover (see chart below). And right now, the underlying economic data for the US may be softening, but it remains solid.

Fahad said: “It’s worth remembering that such volatility in markets is a normal part of investing. Markets often experience a sell off every year and, with strong market performance for the best part of two years, we were overdue.”

He added: “While we continue to monitor the situation, and stand ready to make changes if necessary, our investment approach is about long-term positioning, not knee-jerk reactions. And right now, we still see positive underlying signals for stock market investing.”

As detailed in the chart below, between 1999 and 2024, the S&P 500’s annual returns finished above its largest fall within the year. In fact, the index was able to return positive annual returns 19 times out of 26 over this period despite its intra-year decline.

Past performance should not be taken as a guide to future performance. The value of investments, and the income from them, can fall as well as rise and you may not get back what you put in. You should continue to hold cash for your short-term needs.

A rebalance of economic growth

While economic growth is slowing, we do not currently forecast a US recession this year. Instead, the policy changes imposed by the US could actually drive more balanced global growth, narrowing the gap created by recent US outperformance.

Both fiscal and monetary policy should support this trend. For example, the European Central Bank is currently in a rate cutting cycle and governments within Europe are increasing their defence spending – both potentially positive moves for investors.

Fahad said: “It’s worth noting that, while the US slowdown is occurring, the economic outlook for other regions such as Europe and Asia is accelerating, supporting aggregate global economic growth and earnings.

“Fundamentals remain key. The most recent earnings season, where companies reported how their businesses performed for the last quarter of 2024, offered a positive outlook for 2025. Companies announced robust earnings and expectations for ongoing growth, and the data does not currently contradict that.”

Diversification is key

For us, a key element of managing bursts of market volatility within our clients’ portfolios and funds is diversification. For example, we take a global approach to our equity holdings, investing across various regions and sectors to help mitigate risks.

We also provide ballast in other ways. With the US dollar recently depreciating against the pound, our analysis found sterling to be undervalued, so we increased our exposure to sterling-denominated assets. This diversified our holdings further.

Additionally, we hold an allocation to government bonds which typically help cushion our portfolios and funds from the worst of stock market falls.

But that’s not all. We also invest in a liquid alternatives fund which isn’t correlated with either stock or bond markets. It is designed to generate stable returns regardless of how other markets perform.

Fahad said: “We understand such times of uncertainty can be unsettling. But our ‘anchor and cycle’ approach to investing is designed to ensure that, while we navigate where we are in the current business cycle, we stay focused on what matters most – long-term economic fundamentals.

“This, along with strong diversification within our investments and positioning based on hard data instead of headlines, means we feel well-positioned for current conditions.”

More insights