Personal Finance | 7 March 2025

“If we want to drive systemic change, we must put capital into the hands of female founders”

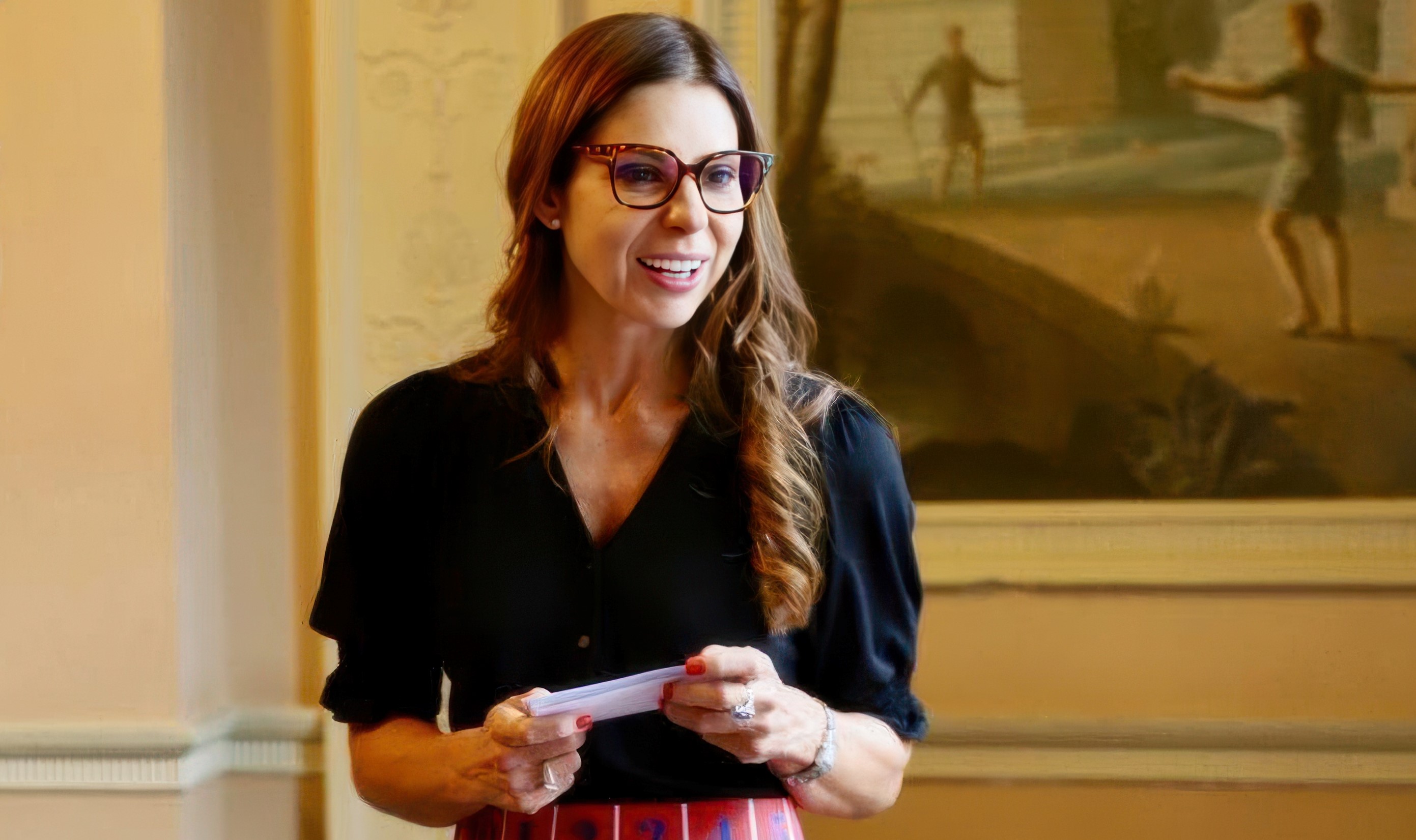

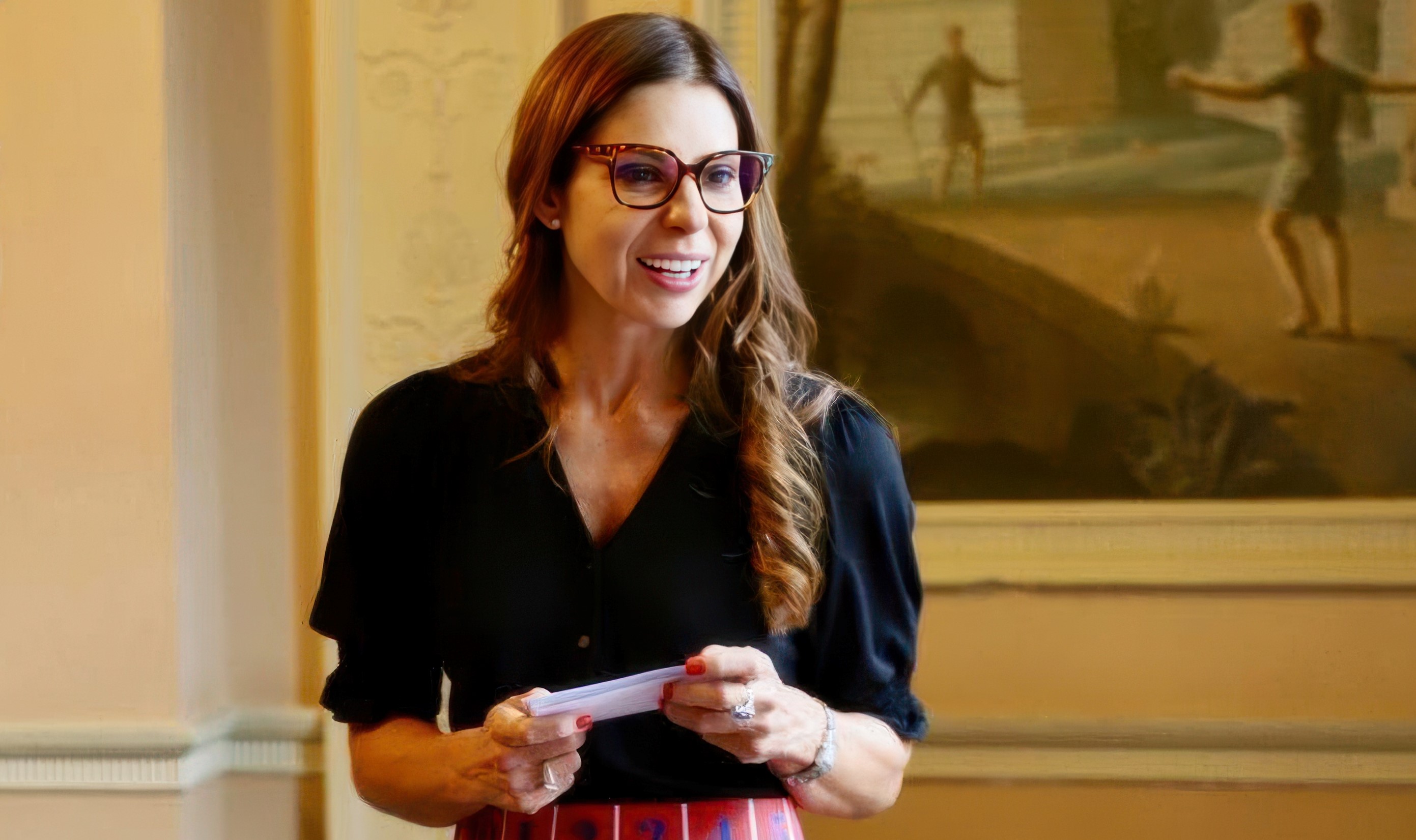

Debbie Wosskow OBE, Co-chair of the Invest in Women Taskforce, underscores how more female business leaders could unlock growth for the entire nation.

This article is taken from our exclusive special report – What’s the New Ambition for UK Entrepreneurs?

For too long, female entrepreneurs have been locked out of the capital they need to build and scale their businesses. Policy makers, investors and entrepreneurs have acknowledged the problem, yet progress remains painfully slow.

Despite meaningful attempts to address this — identifying the challenges, why they persist and how they can be tackled, including the pioneering Rose Review — the numbers tell a different story: progress isn’t just slow – it’s reversing.

For too long, female entrepreneurs have been locked out of the capital they need to build and scale their businesses. Policy makers, investors and entrepreneurs have acknowledged the problem, yet progress remains painfully slow.

Despite meaningful attempts to address this — identifying the challenges, why they persist and how they can be tackled, including the pioneering Rose Review — the numbers tell a different story: progress isn’t just slow – it’s reversing.

In 2023, 2.5% of equity investment went to all-female founder teams. By mid-2024, that figure dropped to just 1.8%, while all-male teams continued to secure over 80% of equity investment*.

The Invest in Women Taskforce is tackling this imbalance by doing what matters most: getting more money into the hands of women. By driving change on both sides of the investment coin — enabling more female and mixed businesses to access the funding they need to succeed and ensuring that more women control investment decisions.

The data is clear: women back women, yet just 14% of senior investment members in the UK are women**. If we want to drive systemic change, we must put capital into the hands of female founders and break the cycle of underinvestment in these often-overlooked businesses.

That’s why the Taskforce is convening one of the world’s largest investment pools with a clear mandate to back female and mixed businesses, deployed by female investors. In November 2024, we exceeded our initial funding target, securing over £250 million. But this is just the start, we must continue expanding this pool to ensure sustained, long-term impact.

Beyond institutional capital, we aim to increase the number of female angel investors from 14%***, as well as looking at the funding needs of businesses just starting out. Across the broader ecosystem and financial services industry, we are working as a collective to enable more women to consider entrepreneurship — ensuring that they have the tools, resources and networks needed at the right time to start, run and scale their businesses, and removing obstacles in their way.

However, these efforts must be underpinned by strong policy frameworks that ensure long-term sustainability and impact. Raising awareness around important policies such as the Seed/Enterprise Investment Scheme (S/EIS) can benefit both investors and female entrepreneurs.

"We are at a pivotal moment to drive real change"

The Investing in Women Code, a government-led initiative that emerged from the Rose Review, is another critical tool in supporting female founders. We need more signatories to this Code and to push for more meaningful action and best practice across those signatories.

The Chancellor’s endorsement of the Invest in Women Taskforce**** sends a clear message that investing in women is not just about equality — it is an economic imperative for growth, innovation, and long-term prosperity.

With continued government support, we are at a pivotal moment to drive real change. It is time to break down the barriers that hold female entrepreneurs back, expand access to capital, and ensure that the ecosystem we build is one where women can thrive.

We cannot be content with incremental progress; we must push forward with urgency. Through collective action, bold policies, and a focus on outcomes, we can create a future where female entrepreneurs are fully empowered — unlocking growth, innovation and prosperity for the entire nation.

MORE TO DISCOVER

FIND OUT HOW COUTTS SUPPORTS ENTREPRENEURS

*Funding female-powered businesses: Making the UK the best place in the world to be a female entrepreneur, Invest in Women Taskforce, accessed February 2025

**Diversity & Inclusion 2023 Report, BVCA and Level 20, 2023

***Women Angel Insights: The impact of female angels on the UK economy, Women Backing Women, Beauhurst, UK Business Angels Association and NatWest Group, September 2022

****Chancellor: “Everyone can do something for women’s equality”, HM Treasury, September 2024