Investing & Performance | 20 February 2025

CIO Update – manufacturing growth

A volatile start to the year for markets amidst trade wars doesn’t mask a recovering manufacturing industry.

Investors have had to navigate a reactive market environment in the early stages of 2025. News including the launch of a competitor artificial intelligence model and the roll out of US tariffs have caused markets to stir. However, macro data has been telling a different story.

Investors have had to navigate a reactive market environment in the early stages of 2025. News including the launch of a competitor artificial intelligence model and the roll out of US tariffs have caused markets to stir. However, macro data has been telling a different story.

During Donald Trump’s presidential campaign, one sector he was eager to revive was America’s manufacturing sector.

Since 2022, the manufacturing sector has experienced a period of sluggish activity. However, amidst the market volatility, this is slowly beginning to change.

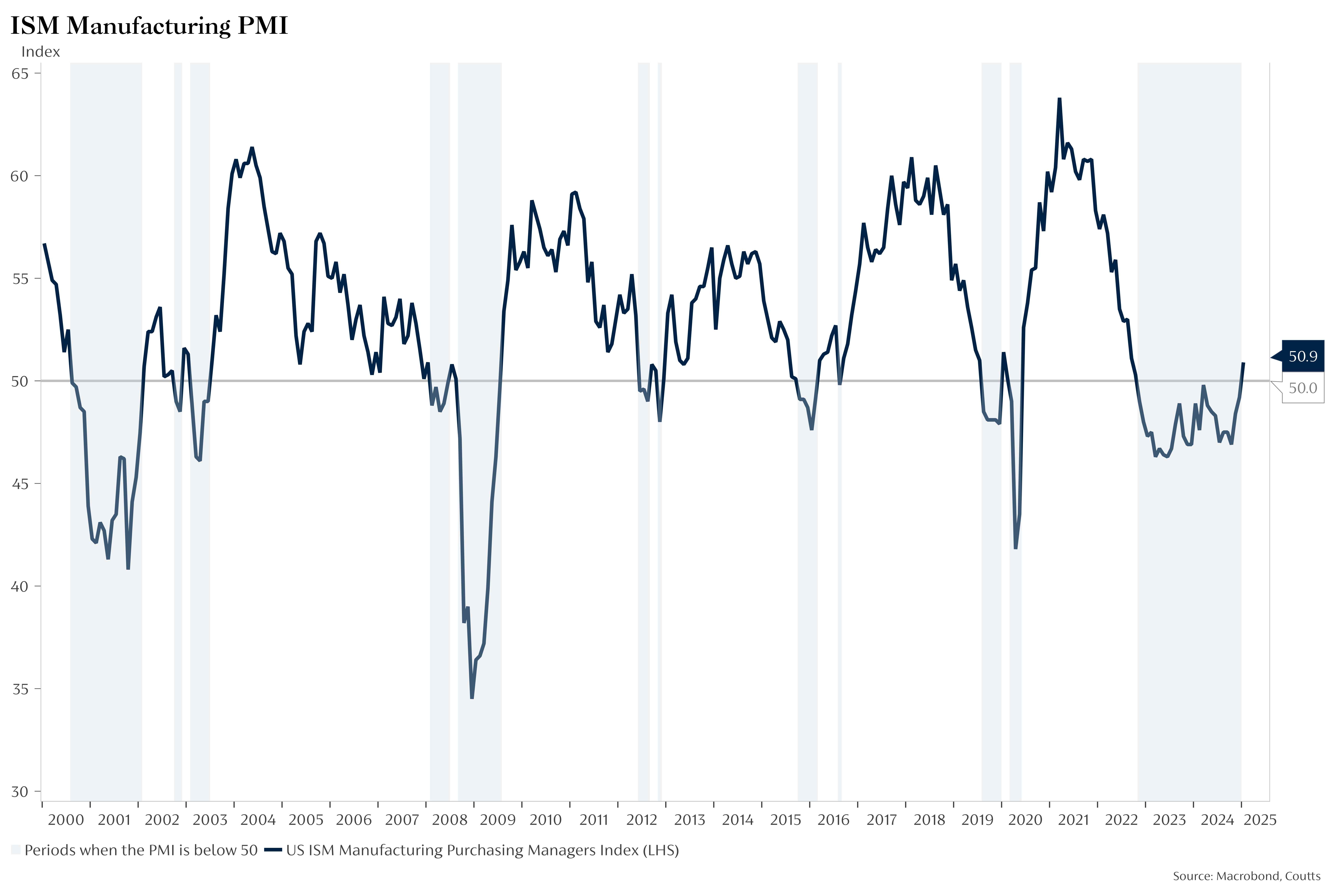

As detailed in the graph below, the industry is slowly ramping up its output for the first time in 16 months. The US ISM Manufacturing Purchasing Managers’ Index records the sector’s business activity. As of January 2025, it has surpassed 50 points – a key threshold which indicates activity is expanding.

Highlighted in grey are the periods where the index is below 50, which has been the case for the past two years.

If it can sustain this momentum, this would support more balanced economic growth and a broadening of earnings growth for the US. We believe it can.

Nonetheless, one factor that sparked the market volatility so far this year could also play a role in preventing this recovery. Tariffs will disrupt supply chains and have the potential to stall business cycle momentum. Although the data does suggest we are seeing increasing signs of recovery in this sector, uncertainty is higher than usual given the trade war risk.

This is part of our new series ‘CIO Update’, showcasing our in-house analysis and research.

Past performance should not be taken as a guide to future performance. The value of investments, and the income from them, can fall as well as rise and you may not get back what you put in. You should continue to hold cash for your short-term needs.

More insights