Investing & Performance | 17 March 2025

CIO Update – Guten tag, fiscal spending

A potential end to Germany’s long-lasting tight fiscal policy could suggest an improving economic outlook.

Germany’s Chancellor-in-waiting Friedrich Merz plans to loosen the nation’s long-standing tight fiscal policy after gaining parliamentary approval over the weekend. The financial package will fund development of Germany’s infrastructure and defence as part of Merz’s aspirations to boost the economy and reduce Europe’s dependency on the US.

Germany’s Chancellor-in-waiting Friedrich Merz plans to loosen the nation’s long-standing tight fiscal policy after gaining parliamentary approval over the weekend. The financial package will fund development of Germany’s infrastructure and defence as part of Merz’s aspirations to boost the economy and reduce Europe’s dependency on the US.

This has unfolded after Germany’s election in February which concluded with a likely coalition government led by the conservative CDU/CSU alliance working alongside the Social Democrats (SPD).

Looser fiscal spending

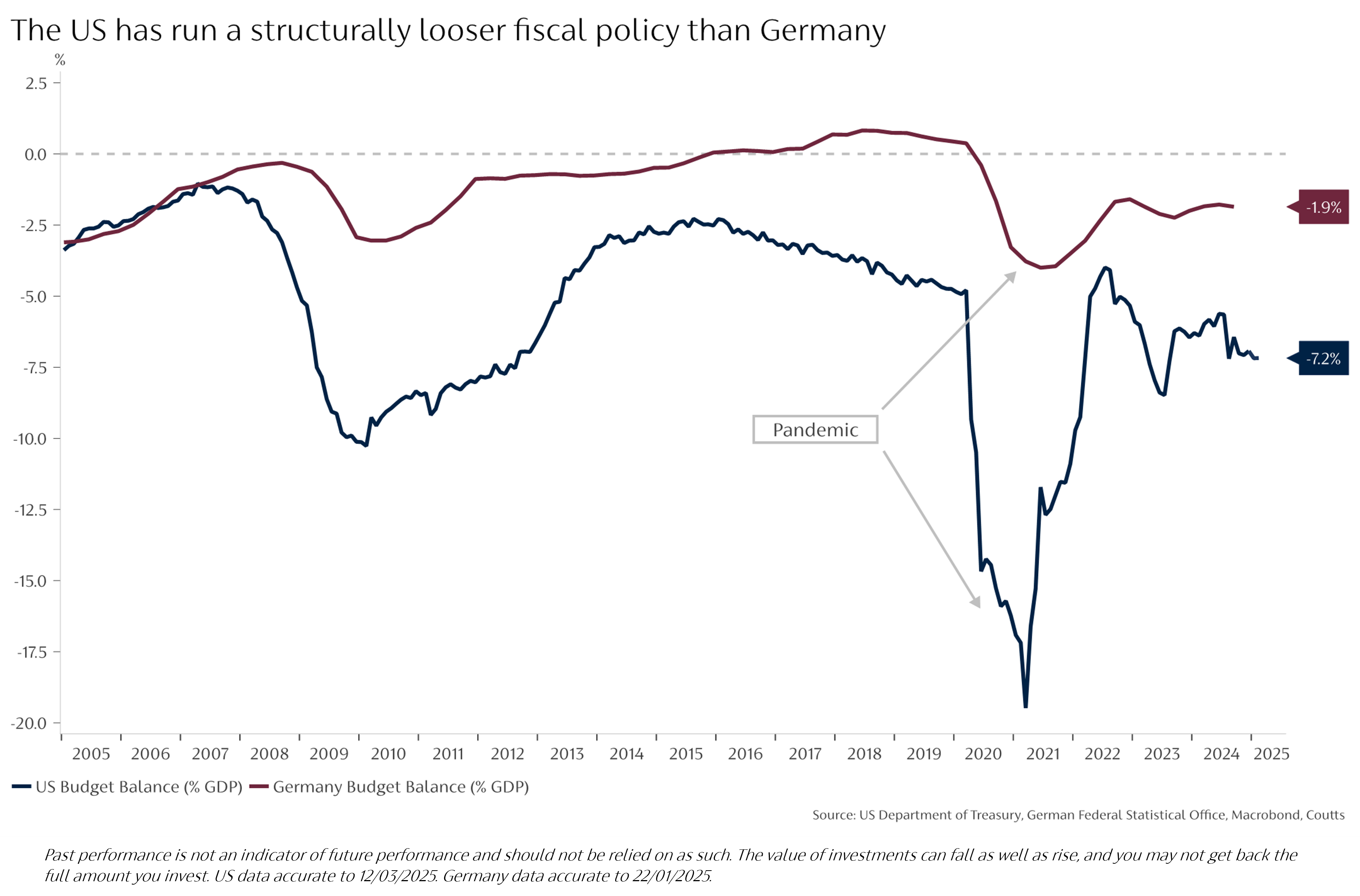

Historically, Germany has been far more committed to a balanced government budget compared to other developed markets. This is where the government’s spending equals its income through sources such as taxes. But as Germany plans to up its spending, economists expect an uptick in nominal GDP growth and government bond supply.

The chart below shows Germany’s fiscal policy compared to the much looser US. Germany’s budget balance since 2003 has tiptoed the zero mark with the exceptions of the 2008 global financial crisis and 2020 Covid pandemic. Comparatively, the US has comfortably stayed in a deficit over the same period.

The US said it planned to withhold sending any further aid to Ukraine to encourage a peace treaty to be agreed with Russia. The White House has since resumed its military assistance amid discussions of a ceasefire. However, the recent indifference by the US meant Germany and a number of European allies plan to ramp up their defence spending to reduce their reliance on the US.

The magnitude and speed at which Germany is rolling out its fiscal plans have initially concerned government bond markets. Over the weekend, Merz clinched parliamentary approval for the financial package which could see Germany’s deficit widen by 1-3%.

what this means for markets

Bund yields could climb higher, but markets are still working out what this fiscal policy shift means for Germany. This isn’t the first time Germany has proposed upping its fiscal spending. In 2019 when the US instigated a trade war with a number of trading allies, Germany suggested increasing its fiscal stimulus. Ultimately though, that didn’t materialise.

Fiscal spending on infrastructure and defence could be positive for Germany’s stock markets. The DAX, Germany’s leading index, has already steadily climbed year to date, reaching all-time highs.

And there is another potential positive for global investors. Tighter fiscal policy has been a key factor behind European economic underperformance versus the US over the last decade. Although structural headwinds will remain, such as low productivity growth and increasing trade tensions, meaningful fiscal stimulus in Europe could bridge that gap moving forward.

This is part of our new series ‘CIO Update’, showcasing our in-house analysis and research.

Past performance should not be taken as a guide to future performance. The value of investments, and the income from them, can fall as well as rise and you may not get back what you put in. You should continue to hold cash for your short-term needs.

More insights