Investing & Performance | 1 April 2025

CIO Update – Growth expectations

Tariff tensions may be causing market uncertainty but, crucially, the data still shows economic growth going forward. This is expected to keep conditions supportive for long-term investors.

Fahad Kamal, Chief Investment Officer

“Take nothing on its looks; take everything on evidence.”

Those words were written by a former Coutts client – Charles Dickens, in his novel Great Expectations. It’s a pertinent point regarding what we’re seeing in markets at the moment. President Trump’s tariff talk, higher-than-expected US inflation and lower consumer confidence have caused market volatility.

But despite this, the underlying hard data in the US – the evidence – remains healthy. For example, the US labour market is in relatively good shape. In February, unemployment was at a reasonably low 4.1% and employers created 151,000 new, non-farm jobs, according to the Labor Department.

That first number was up slightly on the previous month, and the second was below expectations. But they are still solid figures that bode well for future economic growth. We also continue to see positive real wage growth and solid company earnings in the US.

Meanwhile, while the US Federal Reserve held interest rates at its most recent meeting, markets are still pricing in a growth-supporting interest rate cut in June and another two cuts later in the year.

Expectations falling but economy growing

A large part of investing involves expectations. Short-term market performance often hinges on whether expectations for various facts and figures are missed, met or exceeded.

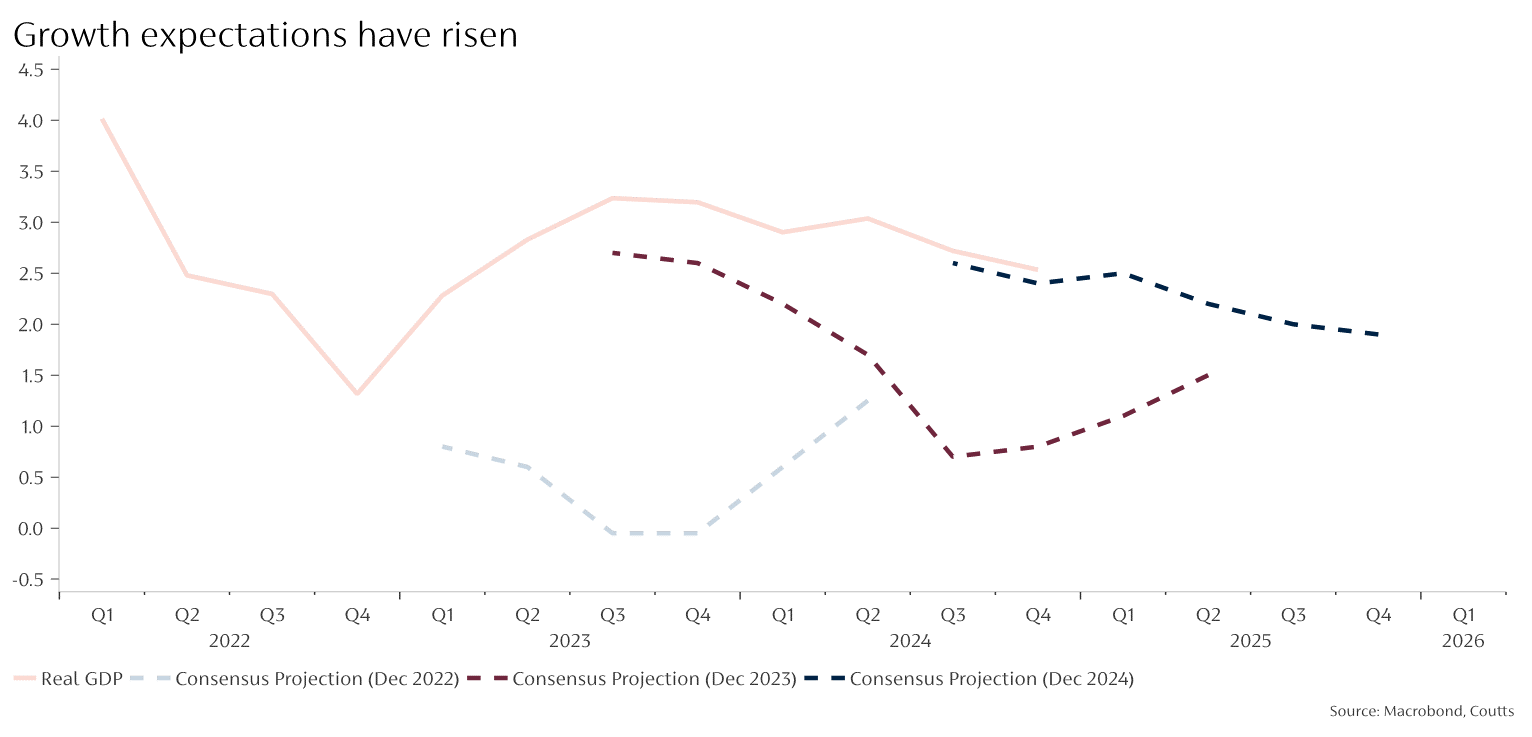

Over the past couple of years, the US economy has well and truly beaten expectations. Concerns of a recession were shrugged off and we instead saw stable growth between 2023 and 2024. This created a favourable environment for investors to take greater risks. Across those two years, the S&P 500 index returned more than 55%, setting a high bar for investors in 2025.

Something we must factor into our investment strategy is how markets manage these expectations this year. Some economic data in the US is now meeting or undershooting – rather than exceeding – previously bullish expectations. But ‘not as good’ isn’t the same as ‘not good’. Going forwards, we would still expect to see a positive overall outcome for markets – it may just come with more periods of short-term volatility compared to last year.

The fact remains that the US economy continues to show signs of growth over the coming months, and while recession probabilities have increased given the uncertainty, it is still not our base case.

The graph below shows consensus projections of US economic growth since 2023 compared to real GDP. Forecasts were significantly beaten in the past two years but this margin is slimming since the last quarter of 2024. This is amplified by rising expectations of growth year on year.

Data accurate as at March 2025. Past performance should not be taken as a guide to future performance. The value of investments, and the income from them, can fall as well as rise and you may not get back what you put in. You should continue to hold cash for your short-term needs.

The importance of diversification

A well-diversified portfolio could help cushion investments during times of market volatility. For us, it’s a key part of our investment philosophy. We diversify our holdings for clients in a number of ways in our multi-asset strategies.

Stocks and bonds: Although not always the case, stocks and bonds tend to move in different directions – while one goes up, the other goes down. We therefore hold an allocation to government bonds to help provide our portfolios with some ballast should stock markets fall. This has been the case with current volatility, with US government bonds up so far this year (as of 31 March).

Regions and sectors: We take a global approach to our equity holdings, investing across a wide range of regions and sectors to help mitigate risks. Within the UK, for example, we use a fund manager equipped to seize opportunities across the whole market – whether they come from large multi-nationals or smaller mid-caps.

Currency: With the US dollar recently depreciating against the pound, our analysis found sterling to be undervalued, so we increased our exposure to sterling-denominated assets. This diversified our holdings further.

Liquid alternatives: For the rare times when stocks and bonds move together, we also invest in a liquid alternatives fund which isn’t correlated with either of them. It is designed to generate stable returns regardless of how other markets perform.

This approach to diversification is thorough and aims to manage short-term volatility while maintaining a focus on the broader perspective. While periods of market volatility can understandably cause concern, the fact remains that the economic fundamentals continue to support long-term growth.

Please contact your Private Banker if you would like to discuss any of the points covered in more detail.

This is part of our new series ‘CIO Update’, showcasing our in-house analysis and research.

More insights