Investing & Performance | 3 March 2025

CIO Update – extending time horizons

Volatility is a part of investing, but it’s important investors focus on the long term and have a robust process to separate the signals from the noise.

The first two months of 2025 have created some uncertainty amongst investors. A trade war between the US and a number of key trade allies, sticky inflation, and declining consumer confidence are just a few examples of what has caused stock markets to jitter year to date.

The first two months of 2025 have created some uncertainty amongst investors. A trade war between the US and a number of key trade allies, sticky inflation, and declining consumer confidence are just a few examples of what has caused stock markets to jitter year to date.

With investing comes risk, and volatility is unavoidable. It can be an uncomfortable situation when markets decline but history shows that it’s most often best to look through the noise as long as the underlying economic and corporate fundamentals remain favourable.

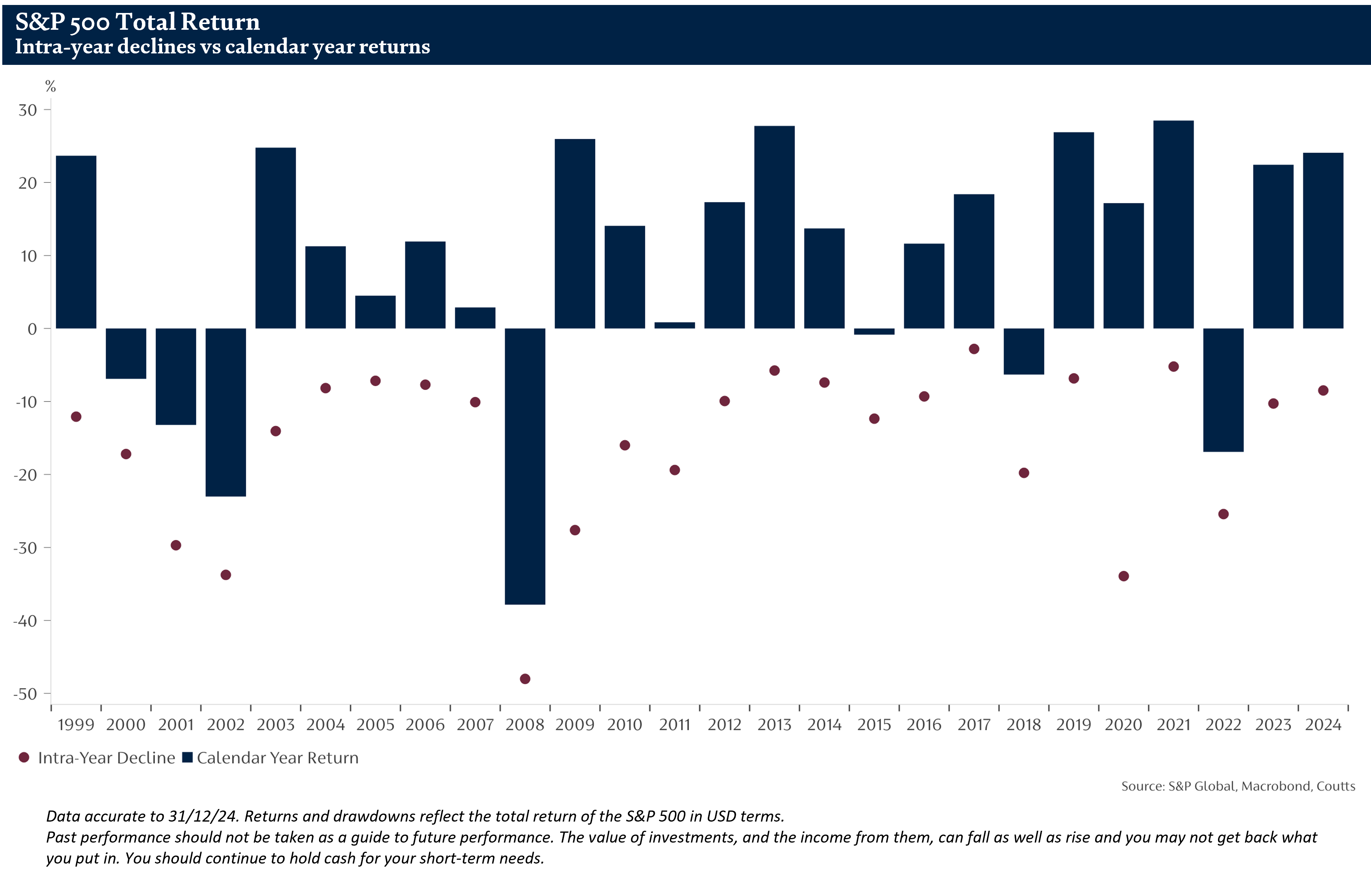

The chart below shows the S&P 500’s annual returns compared to its intra-year declines – peak to trough – between 1999 and 2024. Despite these mid-year declines, the index was able to return positive annual returns 19 times out of 26.

It is hard to gauge whether stock markets will be higher in a month’s time. But it’s important for us as long-term investors to focus on likely outcomes one, two or five years from now. We do this guided by our anchor and cycle investment process, which helps us navigate inherent short-term uncertainties by keeping us focused on what really matters over the investment horizon.

It’s worth getting comfortable being uncomfortable during periods like this. Selling investments could mean cementing any losses and missing out on a market recovery.

Broadening of performance

The US has been a significant driver of equity market performance over the last couple of years. However, the region has been relatively flat since Donald Trump was sworn into office. Instead, some of the notable underperformers from last year are now rallying.

European stocks for example are outpacing their global counterparts after lagging in recent years. This is one example of the broadening out of contributors which may be healthy for global equity performance.

Diversifying risk

When markets are rising, it can be tempting to question the need for diversifiers. But during periods of volatility, the value of holding a range of uncorrelated assets becomes clear. While still maintaining investments in equities, we also hold an allocation to government bonds which typically have an inverse relationship. They have been providing ballast to portfolios in recent weeks.

Taking this one step further, we also diversify our diversifiers via an allocation to a ‘liquid alternatives’ fund. Its strategy is to generate stable returns regardless of whether the market rises or falls, and this position also helped the resilience of our multi-asset portfolios in February.

This is part of our new series ‘CIO Update’, showcasing our in-house analysis and research.

More insights