Investing & Performance | 29 January 2025

CIO Update – the evolution of ai

One of the key themes of 2024 was the adaptation of artificial intelligence (AI). What we are witnessing now is the growth of competition in this area.

Earlier in January, DeepSeek, a Chinese artificial intelligence (AI) start up, launched an AI model designed to compete with its US counterparts at a fraction of the cost. The release of the new AI model has raised concerns for investors on whether the US could maintain its stronghold as a leader in AI development.

Earlier in January, DeepSeek, a Chinese artificial intelligence (AI) start up, launched an AI model designed to compete with its US counterparts at a fraction of the cost. The release of the new AI model has raised concerns for investors on whether the US could maintain its stronghold as a leader in AI development.

As a result, US equities witnessed a sell-off on Monday, with the S&P 500 index falling by roughly 1.5% throughout the day’s trading. The sell-off was driven by a couple of sectors, most notably the technology sector which accounts for nearly a third of that index.

However, it’s worth highlighting that this recent example of market volatility is a regular occurrence and is typical of equity markets. Markets can experience a 10% sell-off every 18 months.

Given the infancy of the AI industry and the excitement it has caused among investors already, it is not a surprise to see competitors making a breakthrough, nor will it be the end of there being ‘winners and losers’ within this theme.

Our outlook on US equities

From an investment perspective, the launch of DeepSeek’s model is timely. We’re in the middle of Q4 earnings season where companies report how their businesses have performed over the previous quarter. A handful of US technology giants will report their earnings in the next couple of weeks.

These announcements may include clues towards the durability of spending in AI and provide a better outlook for how companies adopt the technology.

While the recent news surrounding DeepSeek is highlighting the battle of who can best facilitate the new technology, the adoption of AI continues to evolve. By incorporating the technology into business strategies, all sectors could benefit from cost efficiencies and productivity gains.

The new tool released by DeepSeek, which is a competitor of the widely used OpenAI, is a Large Language Model (LLM) – a type of AI that uses machine learning to generate human language in chatbots. The adoption of this type of model in the labour market is growing significantly.

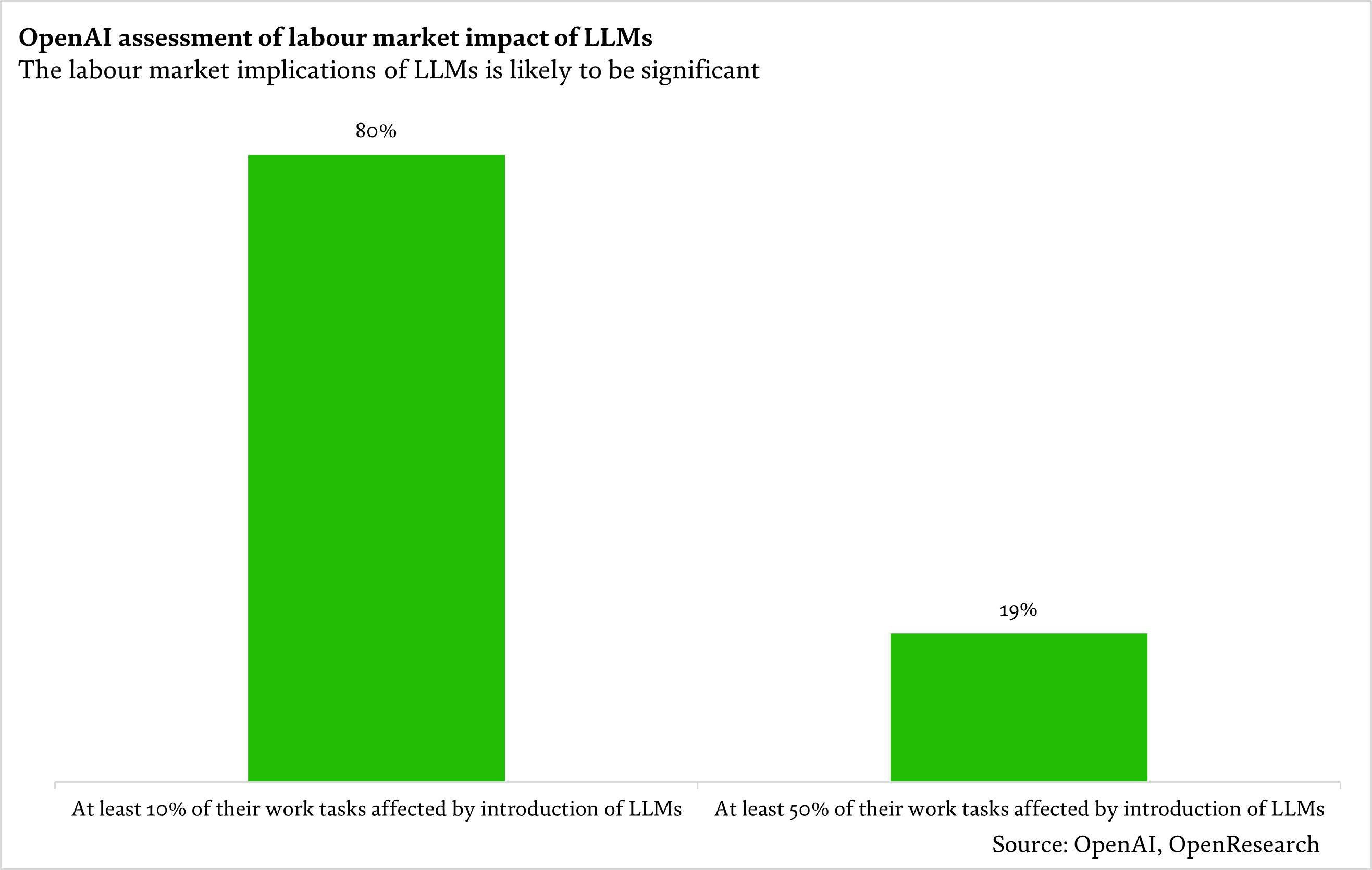

According to OpenAI, 80% of the labour market could see at least 10% of their work tasks affected by the introduction of LLMs. And nearly one-in-five could see more than half their work tasks affected.

The emergence of new facilitators of AI technology within the market may cause some short-term volatility, but it could also create healthy competition and decrease the cost of adoption. These decreasing costs are often fundamental to how technology works and what allows it to improve productivity.

DeepSeek is an impressive innovation but there is a lot more to AI than LLMs or chatbots. We could see further examples of breakthrough companies across the broader remit of AI, making it more accessible for other industries.

This is an exciting period within technology, and because of this, we remain positive towards the future of US equities.

The views represented above reflect the house views of Coutts. However, they may not be applicable in all funds, strategies or portfolios.

This is part of our new series ‘CIO Update’, showcasing our in-house analysis and research.

Past performance should not be taken as a guide to future performance. The value of investments, and the income from them, can fall as well as rise and you may not get back what you put in. You should continue to hold cash for your short-term needs.

More insights