Investing & Performance | 17 October 2024

Cash flow Planning – using your investments for retirement

We answer a few questions you might have if you’re thinking about retiring, want to start taking out capital from your investments, or if you’d like some help planning and managing your income.

There will likely come a pivotal point in your life where you change your financial considerations from ‘how do I grow my wealth?’ to ‘do I still need to work?’.

With Coutts financial planning support, we could help you get a plan in place before this life changing moment to help you ensure your money is working for you.

do I have enough money to retire?

Before enjoying life after work, you first must ensure that you have built up funds effectively and efficiently to finance your retirement. The average pension pot for a high-net-worth individual (HNWI) is nearly £600,000 short of what’s needed for a comfortable retirement, according to the Saltus Wealth Index 2024.

What makes up a retirement fund can vary from one individual to the next. You might have several sources of income for your retirement, for example pensions, investment, rental properties and savings.

How can I prepare for my retirement income?

The amount of money needed for retirement is often uncertain. The Saltus reports highlights that 96% of HNWI over the age of 55 significantly miscalculated how much they would need in their pension pot.

Luke Bishop, Financial Planning Specialist at Coutts, says: “As advisors, we frequently get asked ‘how much do I need to retire?’ or ‘have I got enough to support me for the rest of my life?’. Cash flow planning is essential to enrich these conversations and I have seen the power of demonstrating visually the current situation and how this will change over time.”

That’s why many people find it critical to review their retirement fund early. The purpose of a personal cash flow plan is to capture financial objectives that help identify how achievable your goals are and if you have enough to meet your needs for the rest of your life.

Guiding you through cash flow planning

How you spend your retirement is unique to you, so planning for it should be just as personal. You might be thinking about reviewing long-term income plans so that they’re as efficient as possible. Or maybe want to take out capital from investments.

Through our cash flow planning service, we help our clients build a financial life plan that provides a visual forecast. They can then visualise the income needed and how long your investments might possibly last. Your adviser would help interpret the results and discuss and model a range of possible stress tests to help you plan for any unforeseen events. The final step would be to create an investment strategy by reviewing your existing arrangements to see how they are managed and if they are optimised for your needs.

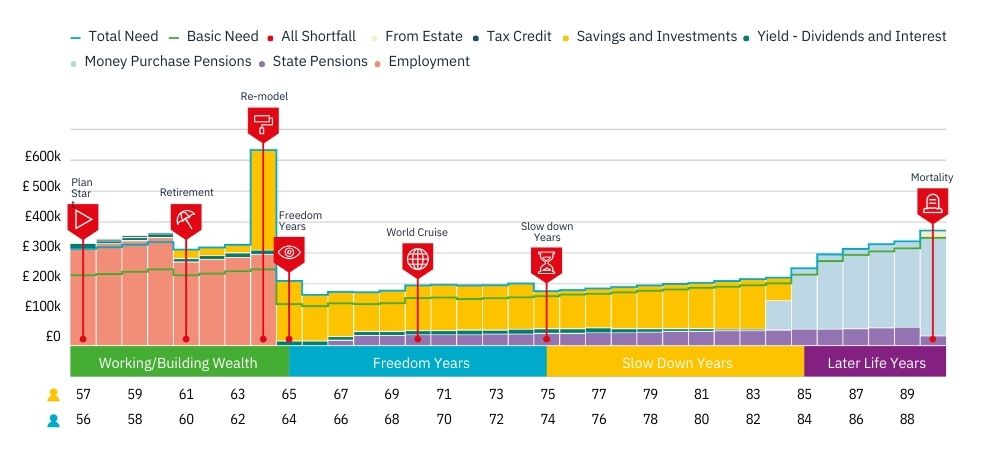

Source: Voyant, Coutts & Co. 2024

The above is an example of the model we develop which breaks down the various streams of income you could be receiving and how long they will last.

Our advisers also review if you’re prepared for all phases in life. From building your wealth towards long-term goals and using your investments to support lifestyle, to efficiently passing on your wealth to future generations.

Luke says it has been a ‘powerful’ tool to assist clients with planning. He explains: “A client of ours previously modelled their own cash flow planning with a spreadsheet and felt a tool that is dynamic and interactive to take into account tax, inflation and wider circumstances would add value to our conversations. I introduced our cash flow model and they have been amazed at the level of detail and the fact different scenarios can be run.”

Assessing your net worth and cash flow – speak to our advisers

Book a consultation with our advisers to see how best you could manage your financial priorities and start enjoying the decades spent putting your money to work.

This costs a one-off flat fee of £7,000 plus VAT. That covers a range of services including protecting your wealth, sorting your pension or structuring your finances tax-efficiently.

Contact Us

Become a client

When you become a client of Coutts, you join a network of exceptional people. Get in touch online or call +44 (0)20 7957 2424 (Relay UK 18001 020 7957 2424) to find out more about our services.

Already a client?

Contact your private banker at any time or call +44 (0)20 7957 2424 (Relay UK 18001 020 7957 2424) for more information.

All calls with Coutts are recorded for training and monitoring purposes.

All calls with Coutts are recorded for training and monitoring purposes.

Eligibility criteria and advice fees apply Coutts works with private clients over 18 who borrow or invest more than £1 million with us. The initial consultation is free, but advice and product fees may apply if you decide to progress your financial plan.

The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. You should continue to hold cash for your short-term needs. Tax reliefs referred to are those applying under current legislation which may change. The availability and value of any tax reliefs will depend on your individual circumstances.

More insights