What’s been driving investment performance in 2019?

The latest investment performance and positioning from Coutts.

2 min read

Notwithstanding any curve-balls that could come in the remaining weeks, stock and bond markets around the world are likely to end the year in positive territory. This means that 2019 has broadly been a good year for investors – especially at Coutts (see below).

Markets have benefited from two major developments this year. Firstly, central banks, led by the US Federal Reserve, have loosened monetary policy to counteract the effects of a slower global economy. And secondly, we’ve seen the gradual relief of two big risks for investors over the last couple of years: the US-China trade conflict and Brexit.

Our investment performance in 2019

Coutts clients have benefitted from these positive developments alongside other investors, but investment performance figures just released show we’ve delivered better returns than our competitors.

We have achieved top quartile performance so far this year (to the end of October), as well as over the last three and five years. And all our sterling products but one have performed better than peers.

THE HEADLINE NUMBERS

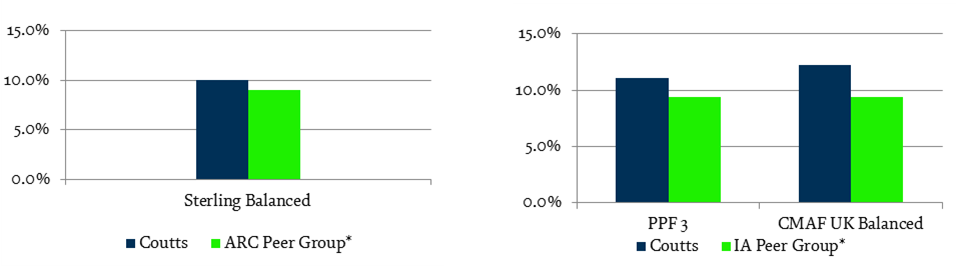

Looking at the performance of just three of our portfolios and funds, so far this year, as at 31 October and net of fees:

- a typical sterling balanced portfolio at Coutts has returned 10% – compared to peer group performance of 9% (Source: Asset Risk Consultants, as at end October 2019)

- our balanced multi-asset fund (Coutts Multi-Asset Fund UK Balanced), which invests in a more-or-less even mix of stocks and bonds, returned 12.2% – compared to 9.4% for peers (Source: Investment Association, as at end October 2019)

- the medium-risk Personal Portfolio Fund, one of five funds that use a mix of active investing and stock market tracking, returned 11.1% – peer group: 9.4% (Source: Investment Association, as at end October 2019). These funds sit behind our easy-to-use online investing option.

*Peer group returns provided by Asset Risk Consultants (ARC) and the Investment Association (IA). The ARC number is an estimate. Both charts show returns to the end of October 2019

Source: Coutts & Co, ARC, IA, November 2019

The table below provides broader context. For a deeper insight, speak to your private banker.

Please remember, when investing, that past performance should not be taken as a guide to future performance. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment.

“Every investment decision we make is based on data, overlaid with the skill and experience of the investment team and scenario planning.”

Our reaction to the news

Mohammad Kamal Syed, Head of Asset Management at Coutts, says, “Every investment decision we make is based on data, overlaid with the skill and experience of the investment team and scenario planning. It is this approach, underpinned by a set of principles that define our investment philosophy, that enabled us to produce these strong results for our clients so far this year.

“For example, our focus on the facts and analysis of the bigger economic picture meant we didn’t become overly defensive when markets became volatile earlier in the year.”

How we’ve achieved our results

While a number of changes we made within our client portfolios and funds benefitted our performance, there are three particular moves we think worth highlighting.

- We bought more US equities. This has been good for performance as US shares have outperformed equities in other regions. Economic growth in the country has proved resilient compared to other developed countries, and the US Federal Reserve has acted to counter slower growth by cutting interest rates.

- We bought more government bonds, particularly in the US. Government bonds provide valuable diversification benefits, particularly in volatile markets such as those we saw over the summer. And the fact that we bought more US Treasuries than gilts was another positive move as the latter fell due to Brexit uncertainty.

- We sold some of our UK commercial property exposure. We used the proceeds from this to buy investment grade bonds instead. UK commercial property has performed well previously, but future return expectations have been dampened by retail sector challenges and Brexit uncertainty. Meanwhile, investment grade bonds offer equivalent yields, but with better liquidity and less sensitivity to the UK-EU split.

What next?

Looking ahead, there are reasons for investors to smile, albeit cautiously because nothing is ever guaranteed when it comes to investing.

The data still shows an ongoing slowdown in global economic growth but we are starting to see some signs of stabilisation, particularly in countries known to lead the business cycle such as China and Taiwan.

Meanwhile, as we expected, the American and European central banks have continued with their policy of lower interest rates and have been talking up support for their slowing economies. Central bank actions are the defining factor of this year’s positive equity performance despite slowing global growth.

Become A Client

When you become a client of Coutts, you will be part of an exclusive network.

| Coutts investments show robust performance in 2019 | ||||||||||||

| 12-month performance to end of last quarter | Calendar year performance | |||||||||||

| 2019 year to date | Annualised since inception* | Sep 14 – Sep 15 | Sep 15 – Sep 16 | Sep 16 – Sep 17 | Sep 17 – Sep 18 | Sep 18 – Sep 19 | 2014 | 2015 | 2016 | 2017 | 2018 | |

| CMAF UK Balanced | 12.2 | 5.9 | -0.8 | 11.1 | 9.5 | 3.2 | 4.7 | 5.5 | -0.4 | 11.8 | 9.5 | -7.0 |

| Balanced Sterling Portfolio | 10.0 | 4.6 | 0.9 | 13.5 | 8.5 | 4.0 | 4.6 | 5.5 | 1.3 | 12.2 | 9.1 | -5.1 |

| PPF 3 – Medium Risk | 11.1 | 8.2 | n/a | n/a | 6.9 | 5.4 | 5.6 | n/a | n/a | n/a | 8.5 | -4.4 |

Numbers shown are percentages. Data as at 31 October 2019. Source: Coutts. All returns in sterling, net of fees.

* CMAF UK Balanced inception date: 14/11/2012

Balanced Sterling Portfolio inception date: 31/12/2006

PPF 3 inception date: 1/6/2016

If you would like to talk to us about investing with Coutts, please speak to your private banker or wealth manager, or call Coutts 24 on +44 (0) 20 7957 2424

When investing, past performance should not be taken as a guide to future performance. The value of investments, and the income from them, can go down as well as up and you may not recover the amount of your original investment.

About Coutts investments

With unstinting focus on client objectives and capital preservation, Coutts Investments provide high-touch investment expertise that centres on diversified solutions and a service-led approach to portfolio management.

Discover more about Coutts investments